IRR is a financial calculation and it can determine an investment’s profitability. This calculation considers the cash flows over the life and provides a rate of return. This return number measures how efficient the investment is. There are multiple formulas for calculating IRR including excel one.

Table of Contents

But they all rely on taking into account the present value of each cash flow. If you learn how to calculate IRR it can help you to decide where to invest money. It is a good way to see how you do with investments before paying someone else to advise you tough.

how to calculate irr? irr calculation

When making an important financial decision, it is crucial to use accurate information. One of the most important calculations you can make is the Internal Rate of Return IRR. Because this tells you how successful your investment will be. But what is the formula to calculate IRR? And how do you use it correctly?

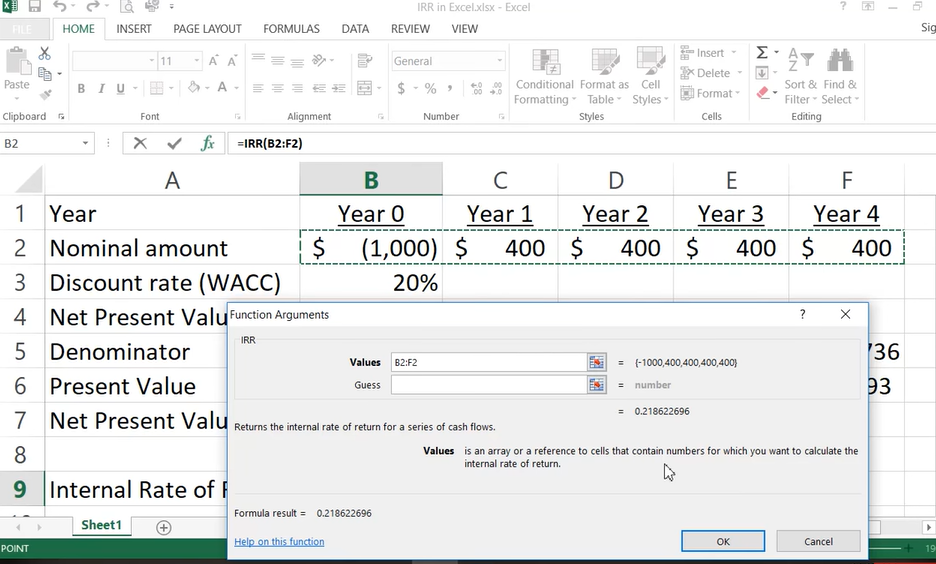

There are two ways to calculate IRR. The first way is to use Excel formulas. And the second way is to use a financial calculator. If you have Excel tough, we recommend using that method. Because it is more accurate than conventional calculators. Below, we will show you how to calculate IRR in Excel.

The formula for calculating IRR: irr calculation in excel

IRR = NPER(rate, -pmt, pv, fv)

Ok, now you can find explanation for each term in formula below.

- rate: This means the interest rate per period. For example, if you make monthly payments, this would be the annual interest rate divided by 12.

- pmt: It stands for payment per period. This should be a negative number if you are making an investment because you are paying out cash. And a positive number if you are receiving payments because you are receiving cash.

- PV: This is the present value of the investment. This is the amount of money you are investing today.

- FV: The future value of the investment. This is the amount you expect to receive at the end of the investment.

How to calculate IRR in Excel: irr computation in excel

Calculating IRR in Excel is easy even the terms seem a little complicates. You should just follow these steps below.

- First, you should enter your interest rate in cell A1. For example, if your annual interest rate is 12%, you would enter 12% into A1 cell. You will enter 1% into cell A1 if your interest rate is monthly tough.

- Next step is entering the number of payments in cell A2. In case you make monthly payments, you would enter 12 into cell A2.

- Now you should write down current investment in cell A3. This is the amount of money you are investing today.

- So for seeing results, you will enter future value of the investment in cell A4. This is the amount you expect to receive.

- In cell A5, you enter the formula =IRR(A1:A4).

- Yey, it is time to hit enter and your answer will appear in cell A5.

Voila, now you know how to calculate IRR in Excel and start practicing.

When should you use IRR?

IRR is a helpful tool for making financial decisions. But it is not the only tool to see consequences of an investment. So, you should also consider other factors. Such as the payback period and the net present value.

Also, IRR formula can give different results depending on how you apply it. So, you should be sure to use it correctly.

For example, if comparing two investments, you should use the same interest rate for both calculations. Otherwise, one investment may appear more profitable than what it actually is.

how to compute internal rate of return in excel

Overall, IRR is a helpful calculation. Because it provides information about an investment’s profitability. If you understand how to calculate IRR and using it correctly, you can make better financial decisions. And these will help reaching your goals.

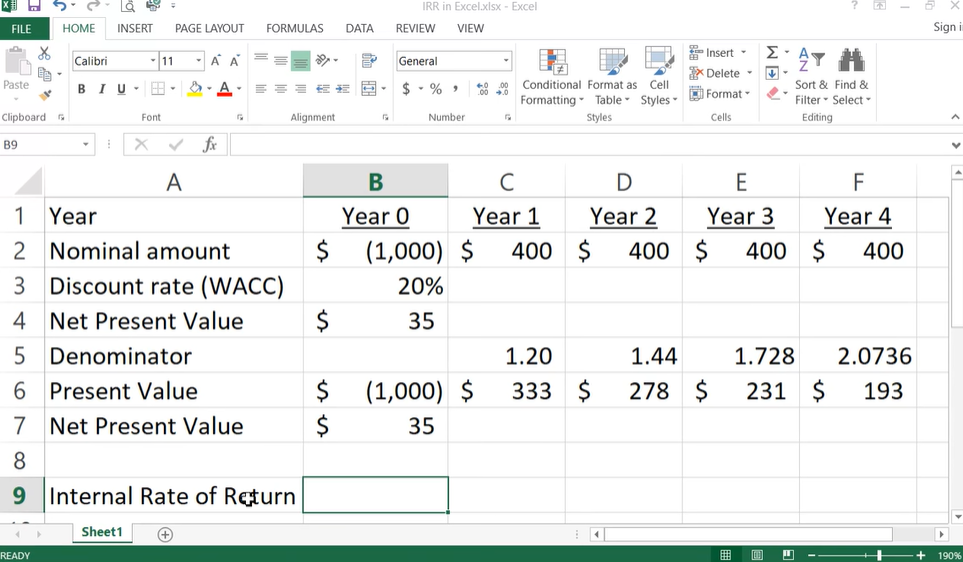

How do I calculate IRR using NPV in Excel?

The IRR function in Excel calculates the internal rate of return for a series of cash flows. Here we are assuming equal-size payment periods. However, you can also use the NPV function to calculate IRR.

To do this, enter your interest rate into cell A1 and your cash flows into cells A2 through A10. Then, in cell A11, you should enter the formula =NPV(A1, A2:A10). This will give you the present value of your cash flows.

how to calculate irr in excel

Next, it is time to create a column with different interest rates (1% to 20%). For each interest rate, you can calculate the NPV using the same cash flows. The interest rate that results in an NPV of 0 is the IRR. This method is less accurate than the IRR function tough.. But it can be helpful if you don’t have Excel or want to see how sensitive irr calculation and changes.

How do you calculate IRR quickly? calculate irr in excel formula

There is no formula to answer to each investment question. But we can say the best way to calculate IRR quickly will depend on your circumstances. However, here are a few tips to help you.

- You should use Excel or another spreadsheet program to automate the calculation. This will save you time and you will have accurate results.

- It is a good choice to use the IRR function if you have Excel. This is the quickest and most accurate way tough.

- In case you don’t have Excel at hand, you can use the NPV function. This method is less accurate for sure. But it can still give you a good idea of an investment’s profitability.

- Another way is using online calculators. Many free online calculators can quickly calculate IRR for you.

- Also, you can consult a financial advisor. In case you are unsure how to calculate IRR or do not have the time to do it yourself, a financial advisor can help. They can also provide other recommendations to help you make sound investment decisions.

A dedicated Career Coach, Agile Trainer and certified Senior Portfolio and Project Management Professional and writer holding a bachelor’s degree in Structural Engineering and over 20 years of professional experience in Professional Development / Career Coaching, Portfolio/Program/Project Management, Construction Management, and Business Development. She is the Content Manager of ProjectCubicle.